Money on mobile

Bank of America has introduced a financial awareness campaign designed to educate students to take control of their finances and discover mobile banking in this upcoming academic year.

The “Morris on Campus, Life According to an Upperclassman” campaign provides college students with tips on how to navigate campus life, including money matters, through Webisodes, additional online content and offline communication pieces.

“One of the interesting findings in the survey is that students don’t do a lot of mobile banking or online banking, which is surprising given that Generation Y is very technology savvy,” said Diane Wagner, Chicago-based spokeswoman for Bank of America.

“We think it’s very important for students away from home for the first time to keep track of their finances and mobile alerts are a great way for them to do just that,” she said.

The national effort aims to help address a recent Bank of America-sponsored survey finding where nearly four in 10 college-aged students (38 percent) reported they can use help in managing their money.

BoA AOK

Bank of America spokesman Morris will introduce students to Bank of America’s new Student Package, a suite of banking products designed specifically for students.

“Students can sign up for a variety alerts to be sent to their phone, including notifications when one of their balances dips below a certain threshold,” Ms. Wagner said. “We want to help them use technology in an easy convenient way while they’re on the go.

“In this day and age students have their mobile phone with them all the time,” she said.

Be Money on Campus contest

Morris will also point students to helpful financial resources, such as the Student Financial Handbook, a downloadable guide that provides students with easy to understand explanations and advice on an array of financial topics.

“College students are a very good demographic that we’re going after,” Ms. Wagner said.

“If you’re a freshman and it’s the first time you’re away from home, you may be getting your first checking account and dealing with a lot of expenses you haven’t had before such as books, supplies, room and board, and phone bills," she said.

“It’s like Banking 101, we’re providing them with basic steps they can take for budgeting and financial planning so they’re prepared and not caught off guard."

The Morris on Campus site can be found at www.bankofamerica.com/oncampus.

In addition to the Bank of America Web site and the campaign portals, the financial institution is spreading the word about the campaign with banner ads on various Web sites and point-of-sale calls-to-action at banking centers and ATM machines nationwide.

“This is a great opportunity to reach out to this segment of our customer base and educate them about mobile banking,” Ms. Wagner said. “It’s a great way for them to keep track of their finances, be savvy and know what they’ve got in the bank before they spend to avoid overdraft situations.”

To continue the dialogue among students concerning their finances, Bank of America has teamed with Farnoosh Torabi, senior correspondent for TheStreet.com and author of "You're So Money" to conduct the national Be Money on Campus contest.

The BMOC contest offers college students a chance to win $25,000 by sharing their best financial tips related to on and off-campus life.

Bank of America’s “Bank with Confidence” survey findings reveal important insights into the viewpoints college students have about their money and finances.

Nine in 10 students (91 percent) feel prepared to manage their finances in the upcoming semester.

Nearly eight in 10 (78 percent) report feeling "knowledgeable" to "very knowledgeable" about saving.

Two out of three (67 percent) feel similarly about balancing their checking accounts.

More than three in four (77 percent) turn to their parents for financial information and advice. One-third (34 percent) discuss finances more than once a week.

However, four in 10 students (42 percent) reported having overdrawn their checking account.

And, surprisingly for Generation Y, one in three students (30 percent) reported not being knowledgeable about online banking and two-thirds (64 percent) were not familiar with mobile banking.

“Using your mobile phone for banking was unheard of until a few years ago,” Ms. Wagner said. “We want to show college students that it’s a great, fun way to look at financial education and get on a budget to save for things that might have importance to you.”

More than four in 10 students (42 percent) say they don’t feel the need to talk to their parents about money, and one in four (25 percent) add they don’t want their parents judging how they spend their money

The survey was conducted by Braun Research via telephone from July 16 to August 13, 2008 of 300 nationally representative U.S. college students ages 18-25 and 300 parents of U.S. college students ages 18-25.

The Student Package, an all-inclusive product suite, includes free online banking service and mobile banking, available to students 18 years and older. These services let customers check balances, receive text and email alerts, transfer funds and pay bills 24/7.

For Bank of America Mobile Banking, you may be charged web access fees by your wireless carrier. Web Access is needed to use mobile banking.

Mobile banking payees and transferees must be previously set up in online banking.

Bank of America is helping educate students on how to develop sound financial decision making with tools like the Student Financial Handbook, Ultimate Money Skills, Making College Financial Planning Count and The Essentials: Your Guide to Credit.

Bank of America serves more than 59 million consumer and small business relationships with more than 6,100 retail banking offices, more than 18,000 ATMs and an online banking service with more than 25 million active users.

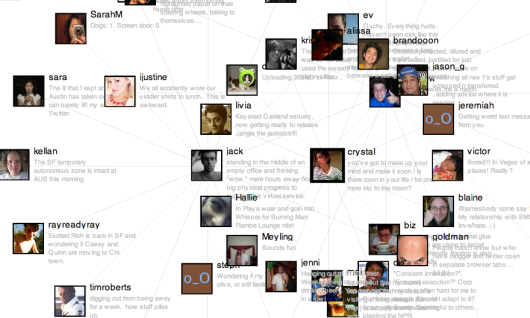

“With our mobile banking, we’ve already reached 1 million people,” Ms. Wagner said. “Mobile banking is a win-win extension of how we can bring our products and services to this Facebook/MySpace generation.”

"If you're looking at a map on a phone, it is usually of the area that you're in, so therefore it would be quite natural for that map to be populated with offers and deals in the area."

"If you're looking at a map on a phone, it is usually of the area that you're in, so therefore it would be quite natural for that map to be populated with offers and deals in the area." "We're actually beginning to see deployments and uptake in consumer adoption. Now is the time for location-based services applications."

"We're actually beginning to see deployments and uptake in consumer adoption. Now is the time for location-based services applications."

NaviKite Application Provides USER CONTROLLED Location Based Ads

MJ Nash, Chief Strategy Officer, WanderSmart Technologies, www.wandersmart.net